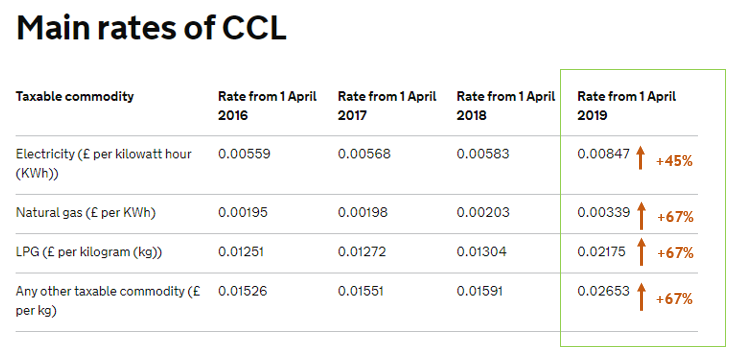

From the 1st April 2019, the Climate Change Levy (CCL) businesses pay on their electricity and gas use increased by 45% and 67% respectively, as shown in the table above. This increase is intended to recoup lost revenue from the early closure of the Carbon Reduction Commitment Energy Efficiency scheme (CRC). To replace the reporting side of the CRC scheme, the Government introduced the new Streamlined Carbon and Energy Reporting, which also came in to effect at the start of the month.

For a number of very large energy users who are currently contributing to the CRC scheme, this transition may actually decrease their energy bills. Organisations with Climate Change Agreements will also be partially insulated from the CCL increase due to a simultaneous increase in their discounts. Nevertheless, for the majority of UK businesses, the energy cost per kWh is set to increase.

Tax on gas has been increased at a higher rate than electricity so as to better reflect the current fuel mix and to support the government’s aim of rebalancing the electricity to gas CCL ratio to 1:1 by 2025. This measure aims to deliver greater carbon savings by further disincentivising the use of gas.

Let’s illustrate the impact of the energy tax increase with an example of one of our 4-star hotel Con-Serve™ users. Based on the hotel’s average annual electricity use (2,694 MWh) and average annual gas use (3,078 MWh), the increase in CCL alone would increase the total costs by £11,300 if no action towards reducing the overall consumption was taken. This calculation also does not take in to account the fact that changes in cooling and heating requirements will likely increase energy bills even further. For example, based on London’s local weather station information, the cooling and heating requirements in 2018 increased by 84% and 5% respectively compared to the previous year. All the more reason to tackle any inefficiencies in operations and minimise resource use.

We can support you in managing the increase in CCL. We have expertise in providing workshops to engage your teams to reduce resource use, or help you track progress of any initiatives that are being rolled out.